Treasury Bill Calendar 2025: A Comprehensive Guide To Short-Term Government Securities

Treasury Bill Calendar 2025: A Comprehensive Guide to Short-Term Government Securities

Related Articles: Treasury Bill Calendar 2025: A Comprehensive Guide to Short-Term Government Securities

- Printable Calendar 2025 Ontario: A Comprehensive Guide To Planning And Organization

- Cobb County School Calendar 2025: Comprehensive Overview

- Monthly Printable Calendar 2025 Free In Word: A Comprehensive Guide

- Wall Calendar 2025: A Timeless Companion For Your Year

- Free Printable Calendar 2025 With Holidays: Essential Planning Tool For The Year Ahead

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Treasury Bill Calendar 2025: A Comprehensive Guide to Short-Term Government Securities. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Treasury Bill Calendar 2025: A Comprehensive Guide to Short-Term Government Securities

Treasury Bill Calendar 2025: A Comprehensive Guide to Short-Term Government Securities

Introduction

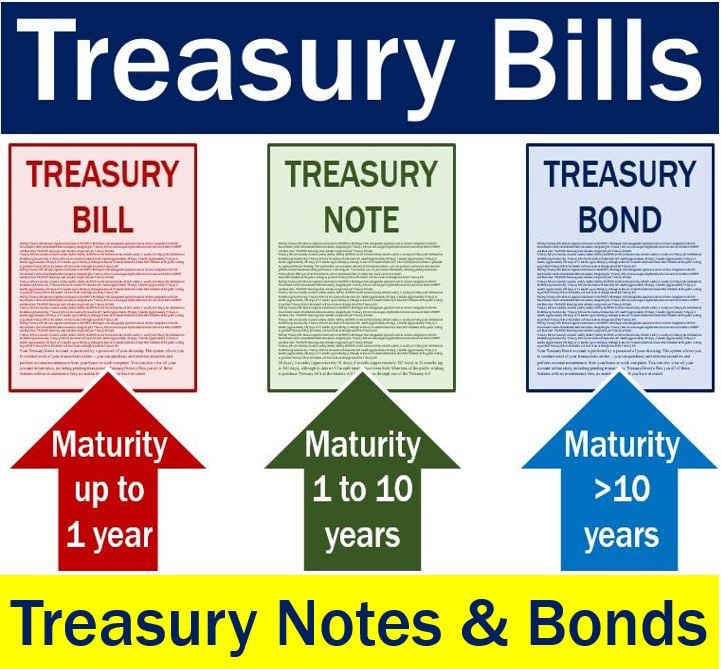

Treasury bills (T-bills) are short-term government securities issued by the United States Department of the Treasury. They are considered among the safest investments, as they are backed by the full faith and credit of the U.S. government. T-bills have maturities ranging from one month to one year, and they are issued in denominations of $1,000, $5,000, $10,000, $25,000, $50,000, $100,000, and $1 million.

Key Features of T-bills

- Short-term maturity: T-bills have maturities ranging from one month to one year, making them a suitable investment for short-term cash management or as a safe haven during periods of market volatility.

- Low risk: T-bills are considered low-risk investments due to the backing of the U.S. government. This makes them a popular choice for investors seeking capital preservation.

- Highly liquid: T-bills are highly liquid, meaning they can be easily bought and sold in the secondary market. This liquidity provides investors with flexibility and the ability to adjust their portfolios quickly.

- Tax benefits: Interest earned on T-bills is exempt from state and local income taxes, making them an attractive investment for high-net-worth individuals and institutions.

T-bill Calendar 2025

The T-bill calendar for 2025 provides a schedule of upcoming T-bill auctions and their corresponding maturity dates. This calendar is essential for investors who wish to plan their T-bill investments effectively. The following table presents the T-bill calendar for 2025:

| Auction Date | Maturity Date |

|---|---|

| January 2, 2025 | January 30, 2025 |

| January 9, 2025 | February 6, 2025 |

| January 16, 2025 | February 13, 2025 |

| January 23, 2025 | March 6, 2025 |

| January 30, 2025 | March 13, 2025 |

| February 6, 2025 | April 3, 2025 |

| February 13, 2025 | April 10, 2025 |

| February 20, 2025 | May 1, 2025 |

| February 27, 2025 | May 8, 2025 |

| March 6, 2025 | June 5, 2025 |

| March 13, 2025 | June 12, 2025 |

| March 20, 2025 | July 3, 2025 |

| March 27, 2025 | July 10, 2025 |

| April 3, 2025 | August 7, 2025 |

| April 10, 2025 | August 14, 2025 |

| April 17, 2025 | September 4, 2025 |

| April 24, 2025 | September 11, 2025 |

| May 1, 2025 | October 2, 2025 |

| May 8, 2025 | October 9, 2025 |

| May 15, 2025 | November 6, 2025 |

| May 22, 2025 | November 13, 2025 |

| May 29, 2025 | December 4, 2025 |

| June 5, 2025 | December 11, 2025 |

| June 12, 2025 | January 8, 2026 |

| June 19, 2025 | January 15, 2026 |

| June 26, 2025 | February 5, 2026 |

| July 3, 2025 | February 12, 2026 |

| July 10, 2025 | March 5, 2026 |

| July 17, 2025 | March 12, 2026 |

| July 24, 2025 | April 2, 2026 |

| July 31, 2025 | April 9, 2026 |

| August 7, 2025 | May 7, 2026 |

| August 14, 2025 | May 14, 2026 |

| August 21, 2025 | June 4, 2026 |

| August 28, 2025 | June 11, 2026 |

| September 4, 2025 | July 2, 2026 |

| September 11, 2025 | July 9, 2026 |

| September 18, 2025 | August 6, 2026 |

| September 25, 2025 | August 13, 2026 |

| October 2, 2025 | September 3, 2026 |

| October 9, 2025 | September 10, 2026 |

| October 16, 2025 | October 1, 2026 |

| October 23, 2025 | October 8, 2026 |

| October 30, 2025 | November 5, 2026 |

| November 6, 2025 | November 12, 2026 |

| November 13, 2025 | December 3, 2026 |

| November 20, 2025 | December 10, 2026 |

| November 27, 2025 | January 7, 2027 |

| December 4, 2025 | January 14, 2027 |

| December 11, 2025 | February 4, 2027 |

| December 18, 2025 | February 11, 2027 |

| December 25, 2025 | March 4, 2027 |

How to Invest in T-bills

Investors can purchase T-bills through several channels, including:

- TreasuryDirect: This is the official website of the U.S. Treasury Department, where investors can purchase T-bills directly from the government.

- Banks and brokerages: Many banks and brokerages offer T-bill investment services.

- Money market funds: Money market funds often invest in T-bills and other short-term securities.

Factors to Consider When Investing in T-bills

- Interest rates: T-bill yields are inversely correlated with interest rates. When interest rates rise, T-bill yields decrease, and vice versa.

- Inflation: Inflation can erode the purchasing power of returns on T-bills.

- Investment horizon: T-bills are suitable for investors with short-term investment horizons.

- Risk tolerance: T-bills are considered low-risk investments, but they do carry some risk, such as the risk of interest rate fluctuations.

Conclusion

Treasury bills are a valuable investment tool for investors seeking short-term cash management solutions, capital preservation, and tax benefits. The T-bill calendar for 2025 provides investors with a comprehensive schedule of upcoming T-bill auctions and their corresponding maturity dates. By understanding the key features of T-bills and the factors to consider when investing, investors can make informed decisions about incorporating T-bills into their portfolios.

Closure

Thus, we hope this article has provided valuable insights into Treasury Bill Calendar 2025: A Comprehensive Guide to Short-Term Government Securities. We hope you find this article informative and beneficial. See you in our next article!