FY Calendar 2025: A Comprehensive Guide To Fiscal Year Planning

FY Calendar 2025: A Comprehensive Guide to Fiscal Year Planning

Related Articles: FY Calendar 2025: A Comprehensive Guide to Fiscal Year Planning

- 2025 Calendar Month By Month: A Comprehensive Guide

- October 2025 Calendar Wallpaper: A Visual Symphony Of Autumn’s Embrace

- Calendario 2025 Meses: Panduan Komprehensif

- UC San Diego 2025 Academic Calendar: A Comprehensive Overview

- School Calendar For 2025: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to FY Calendar 2025: A Comprehensive Guide to Fiscal Year Planning. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about FY Calendar 2025: A Comprehensive Guide to Fiscal Year Planning

FY Calendar 2025: A Comprehensive Guide to Fiscal Year Planning

Introduction

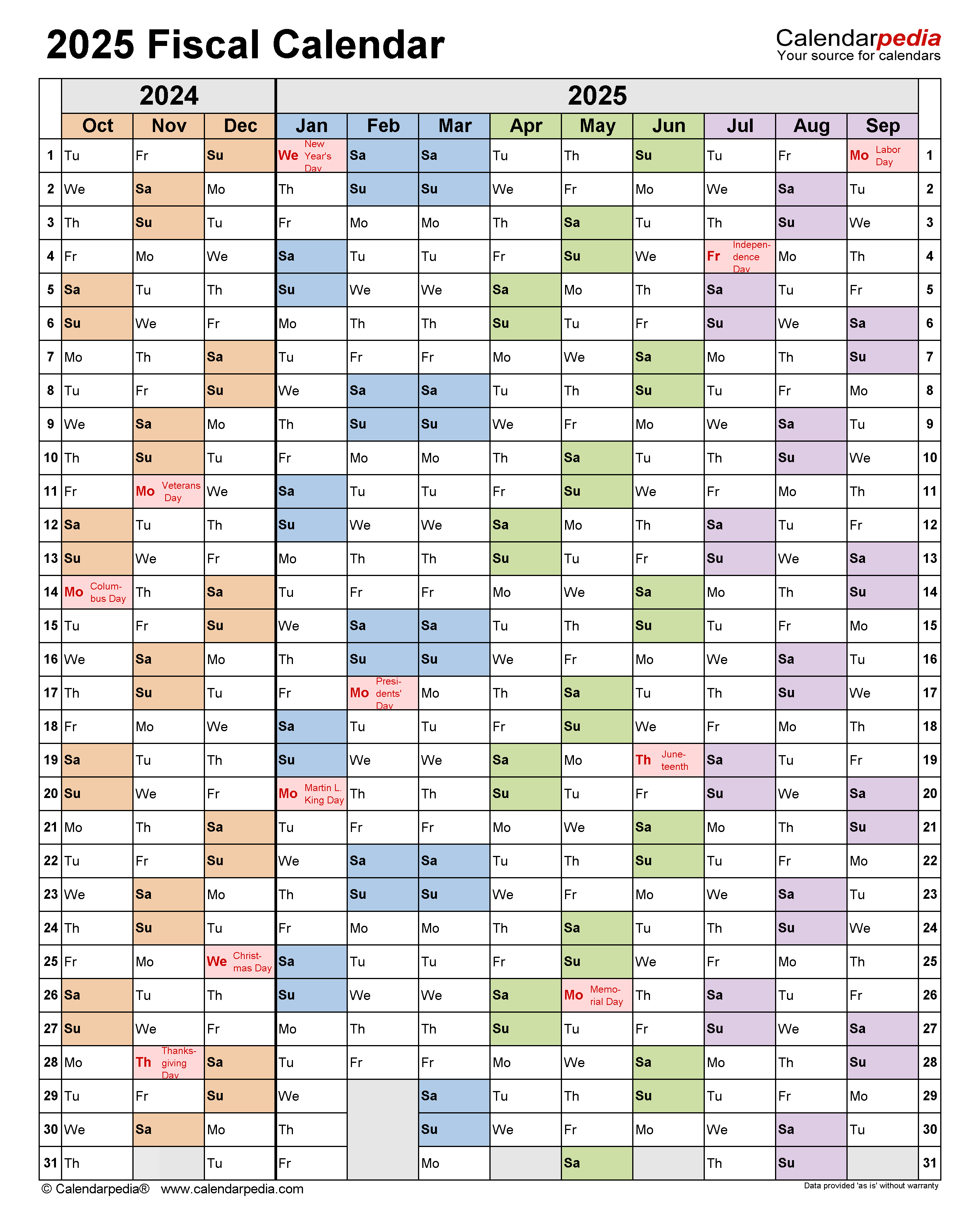

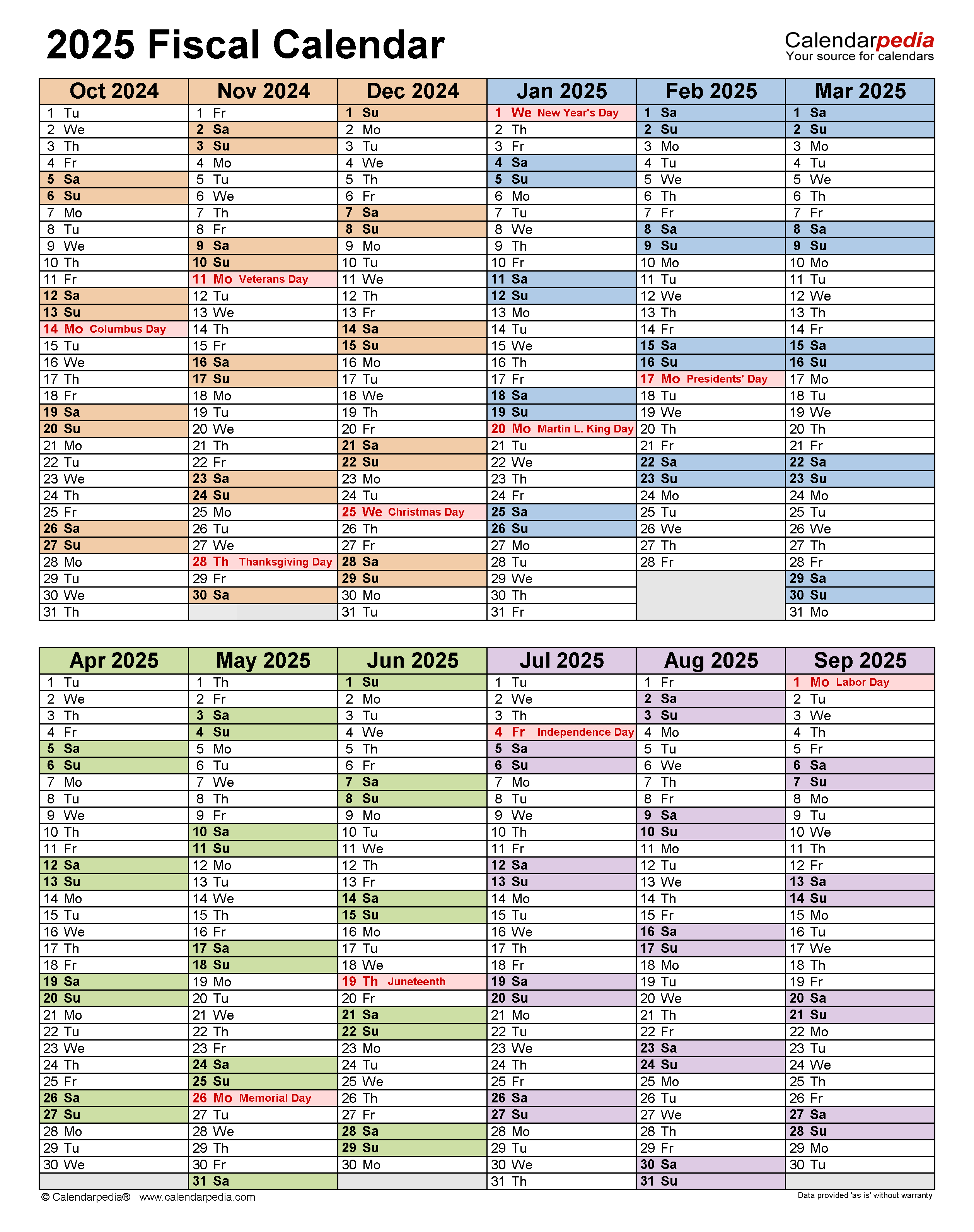

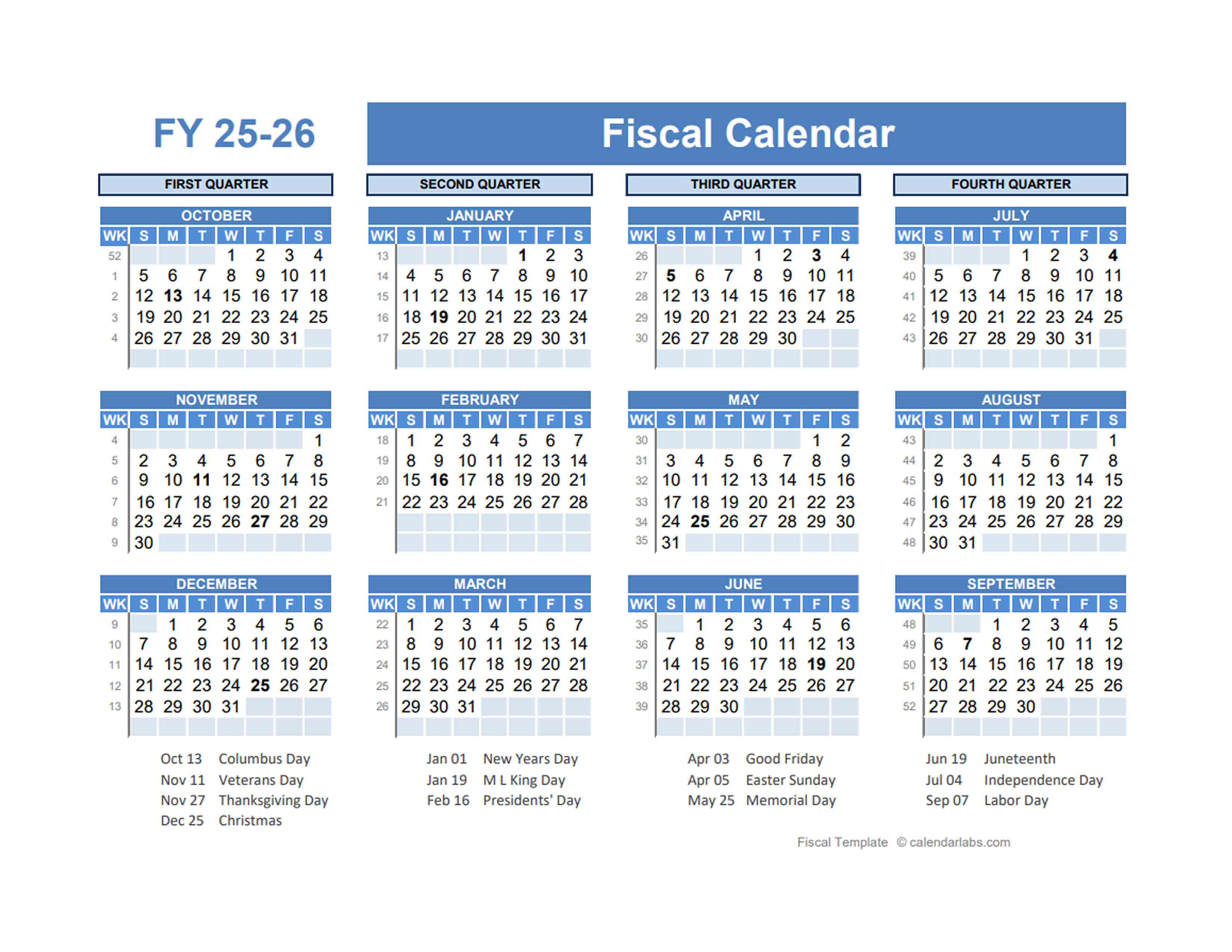

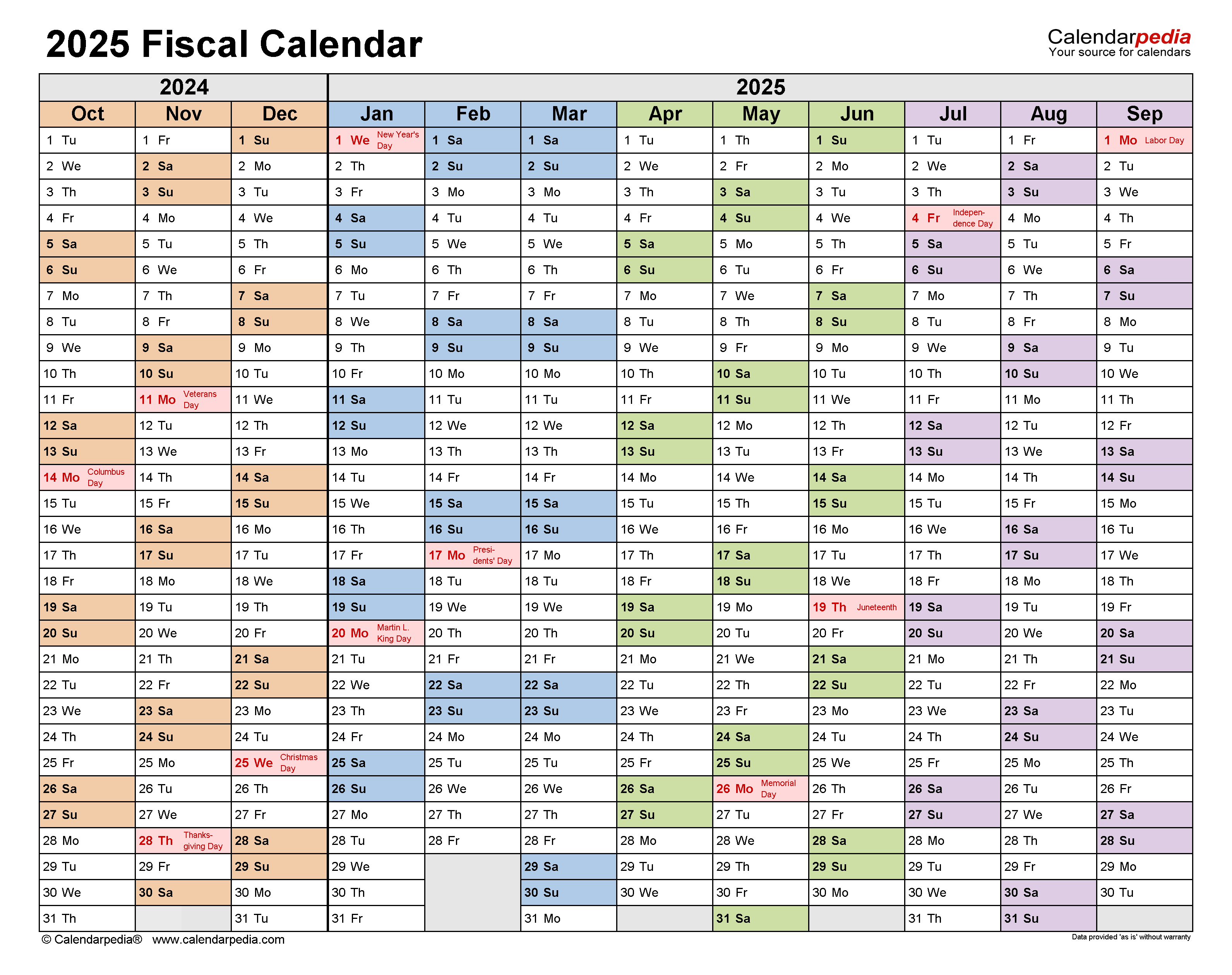

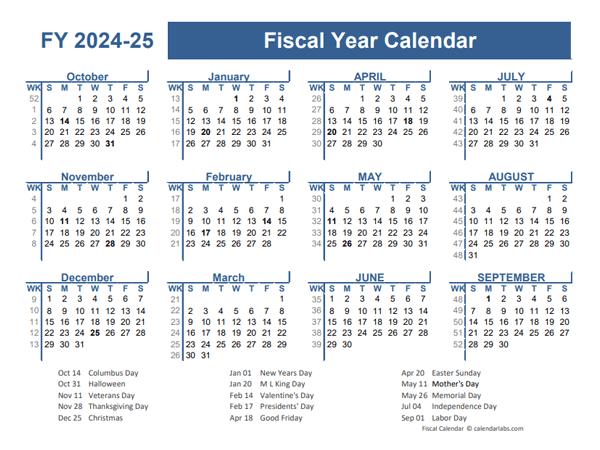

Fiscal year (FY) calendars play a crucial role in financial planning and management for organizations of all sizes. They establish a consistent time frame for budgeting, forecasting, and reporting financial results. The FY calendar 2025, which begins on October 1, 2024, and ends on September 30, 2025, is a particularly significant one as it marks the transition to a new fiscal year. This comprehensive guide will provide a detailed overview of the FY calendar 2025, highlighting its key features, benefits, and considerations for effective fiscal year planning.

Key Features of the FY Calendar 2025

The FY calendar 2025 consists of 12 months, divided into four quarters:

- Quarter 1: October 1, 2024 – December 31, 2024

- Quarter 2: January 1, 2025 – March 31, 2025

- Quarter 3: April 1, 2025 – June 30, 2025

- Quarter 4: July 1, 2025 – September 30, 2025

The fiscal year begins on October 1st and ends on September 30th, aligning with the U.S. federal government’s fiscal year. This alignment simplifies financial reporting and facilitates comparisons with government data.

Benefits of Using the FY Calendar 2025

- Improved Financial Planning: The FY calendar provides a structured framework for organizations to plan their financial activities. It allows for the timely allocation of resources, setting of financial goals, and monitoring of progress.

- Enhanced Forecasting: The consistent time frame of the FY calendar facilitates accurate forecasting of financial performance. Organizations can use historical data and industry trends to make informed predictions about future financial results.

- Streamlined Reporting: The FY calendar aligns with the reporting requirements of many regulatory bodies and external stakeholders. This simplifies the process of preparing and submitting financial statements and other reports.

- Benchmarking: The FY calendar allows organizations to compare their financial performance to industry benchmarks and best practices. This enables them to identify areas for improvement and make informed decisions.

Considerations for Effective Fiscal Year Planning

- Align with Business Objectives: The FY calendar should be aligned with the organization’s strategic objectives and business goals. This ensures that financial planning and decision-making support the overall vision and mission of the organization.

- Involve Key Stakeholders: Engage key stakeholders, including management, finance team, and other departments, in the fiscal year planning process. Their input and perspectives will contribute to a more comprehensive and effective plan.

- Monitor and Adjust: Regularly monitor financial performance against the FY calendar and make adjustments as needed. This will ensure that the plan remains relevant and aligned with changing business conditions.

- Use Technology: Leverage technology to automate financial planning and reporting tasks. This can save time, improve accuracy, and provide real-time insights into financial performance.

Tips for a Successful Transition to FY 2025

- Communicate Early: Inform employees, vendors, and other stakeholders about the transition to FY 2025 well in advance. This will provide ample time for preparation and minimize disruptions.

- Review and Update Policies: Review and update financial policies and procedures to ensure alignment with the new fiscal year. This includes policies on budgeting, accounting, and reporting.

- Train Staff: Provide training to staff on the new FY calendar and any associated changes in financial processes. This will ensure that everyone is equipped with the necessary knowledge and skills.

- Establish a Transition Team: Consider forming a transition team to oversee the implementation of the new FY calendar and address any challenges that may arise.

Conclusion

The FY calendar 2025 is an essential tool for organizations to effectively plan and manage their financial operations. By aligning financial activities with a consistent time frame, organizations can improve financial planning, enhance forecasting, streamline reporting, and benchmark performance. By carefully considering the key features, benefits, and considerations outlined in this guide, organizations can successfully transition to FY 2025 and maximize the benefits of fiscal year planning.

Closure

Thus, we hope this article has provided valuable insights into FY Calendar 2025: A Comprehensive Guide to Fiscal Year Planning. We appreciate your attention to our article. See you in our next article!