4-4-5 Fiscal Calendar: A Comprehensive Overview For 2025

4-4-5 Fiscal Calendar: A Comprehensive Overview for 2025

Related Articles: 4-4-5 Fiscal Calendar: A Comprehensive Overview for 2025

- Heritage Month Calendar 2025

- Free Printable Monthly Calendar June 2025: Plan Your Month With Ease

- 2025 Calendar With Week Numbers Printable: A Comprehensive Guide To Effective Planning

- May 7, 2025: A Day In The Future

- 2025 Philippines Printable Calendar: A Comprehensive Guide To Free Printable Calendars

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 4-4-5 Fiscal Calendar: A Comprehensive Overview for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 4-4-5 Fiscal Calendar: A Comprehensive Overview for 2025

4-4-5 Fiscal Calendar: A Comprehensive Overview for 2025

Introduction

The 4-4-5 fiscal calendar is a non-traditional calendar that divides the year into three quarters of four months each, followed by a fifth quarter of five months. This calendar has gained popularity in recent years due to its potential benefits for businesses, governments, and individuals. In this article, we will provide a comprehensive overview of the 4-4-5 fiscal calendar for 2025, including its advantages, disadvantages, and implementation considerations.

Structure of the 4-4-5 Fiscal Calendar

The 4-4-5 fiscal calendar consists of three quarters of four months each, followed by a fifth quarter of five months. The calendar is designed to align with the natural rhythms of the business cycle and to minimize disruptions caused by traditional calendar boundaries.

- Quarter 1: January, February, March, April

- Quarter 2: May, June, July, August

- Quarter 3: September, October, November, December

- Quarter 4: January, February, March, April, May

Advantages of the 4-4-5 Fiscal Calendar

The 4-4-5 fiscal calendar offers several advantages over traditional calendars:

- Improved Cash Flow: The shorter quarters allow businesses to receive and pay invoices more frequently, resulting in improved cash flow and reduced working capital requirements.

- Reduced Seasonality: The 4-4-5 calendar mitigates the impact of seasonal fluctuations by spreading business activity more evenly throughout the year. This can lead to increased efficiency and productivity.

- Enhanced Planning and Budgeting: The three distinct quarters provide natural planning periods for businesses, making it easier to set goals, allocate resources, and track progress.

- Increased Flexibility: The 4-4-5 calendar allows businesses to adjust their operations more easily to changing market conditions. The shorter quarters provide more opportunities for course correction and adaptation.

- Improved Work-Life Balance: The fifth quarter of five months can provide employees with a longer period of time for vacations and personal activities.

Disadvantages of the 4-4-5 Fiscal Calendar

While the 4-4-5 fiscal calendar offers several advantages, it also has some potential disadvantages:

- Tax Implications: Businesses that adopt the 4-4-5 calendar may face tax implications due to the mismatch between their fiscal year and the calendar year used by the tax authorities.

- Compliance Issues: The 4-4-5 calendar may not be compatible with certain regulations or reporting requirements that are based on traditional calendar boundaries.

- Transition Costs: Implementing the 4-4-5 calendar can involve significant transition costs, including accounting adjustments, software upgrades, and employee training.

- Lack of Widespread Adoption: The 4-4-5 fiscal calendar is not widely adopted, which can lead to challenges in coordinating with external stakeholders, such as suppliers and customers.

Implementation Considerations

Organizations considering adopting the 4-4-5 fiscal calendar should carefully consider the following factors:

- Tax Implications: Consult with tax professionals to assess the potential tax consequences of adopting the 4-4-5 calendar.

- Compliance Requirements: Review applicable regulations and reporting requirements to ensure compatibility with the 4-4-5 calendar.

- Transition Costs: Estimate the costs associated with implementing the 4-4-5 calendar, including accounting adjustments, software upgrades, and employee training.

- Stakeholder Coordination: Communicate with external stakeholders, such as suppliers and customers, to ensure smooth coordination during the transition to the 4-4-5 calendar.

- Change Management: Develop a comprehensive change management plan to address the organizational and cultural implications of adopting a new fiscal calendar.

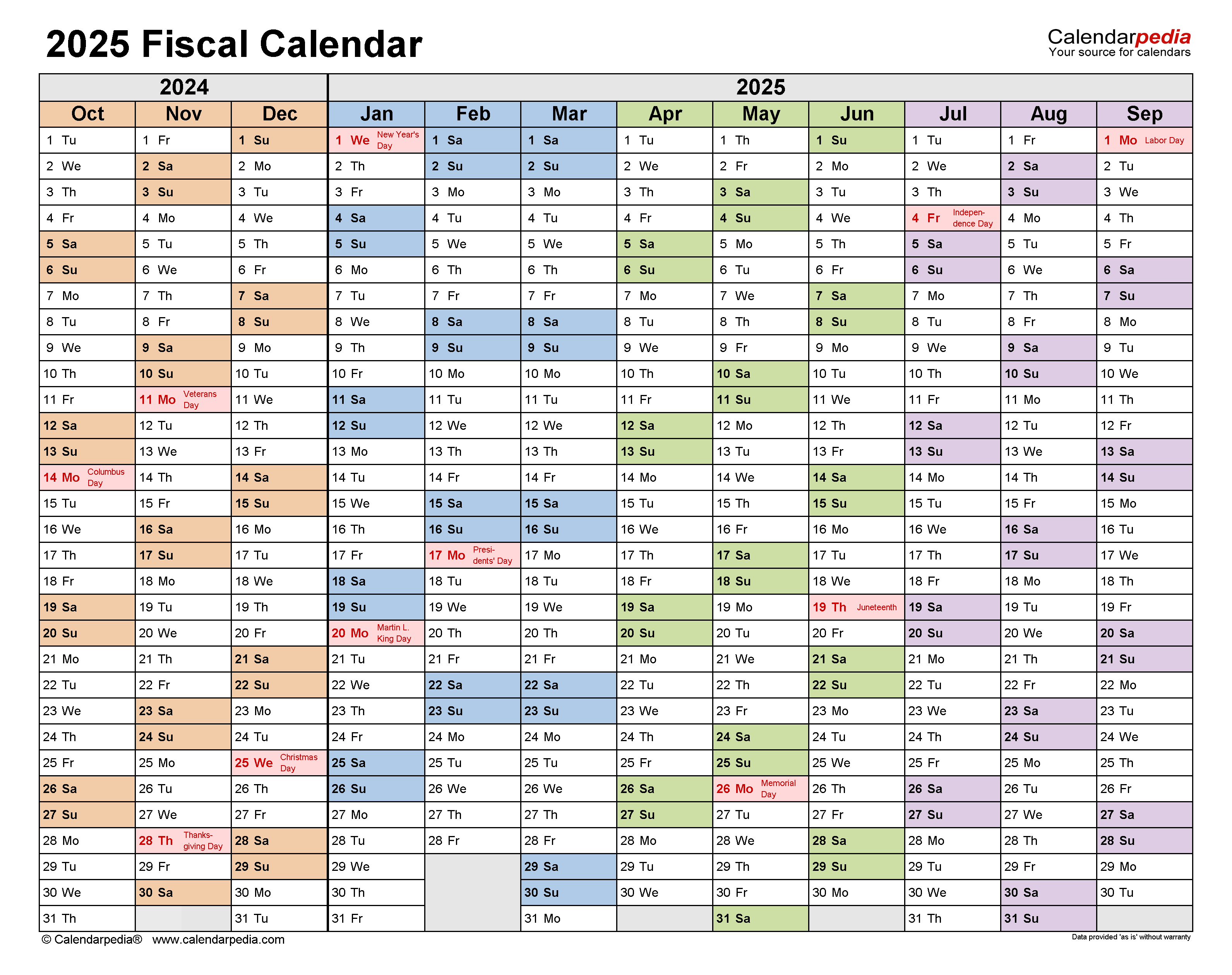

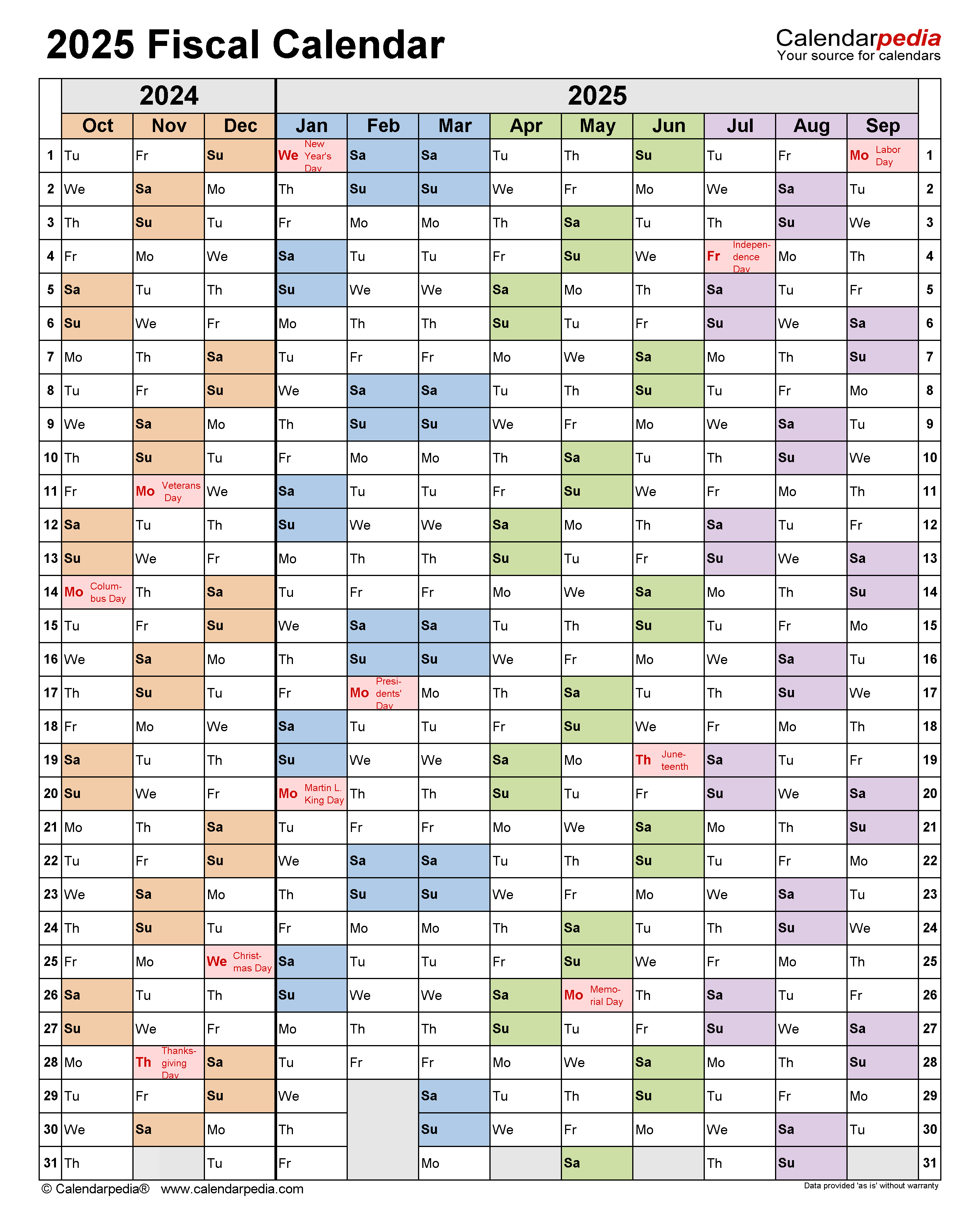

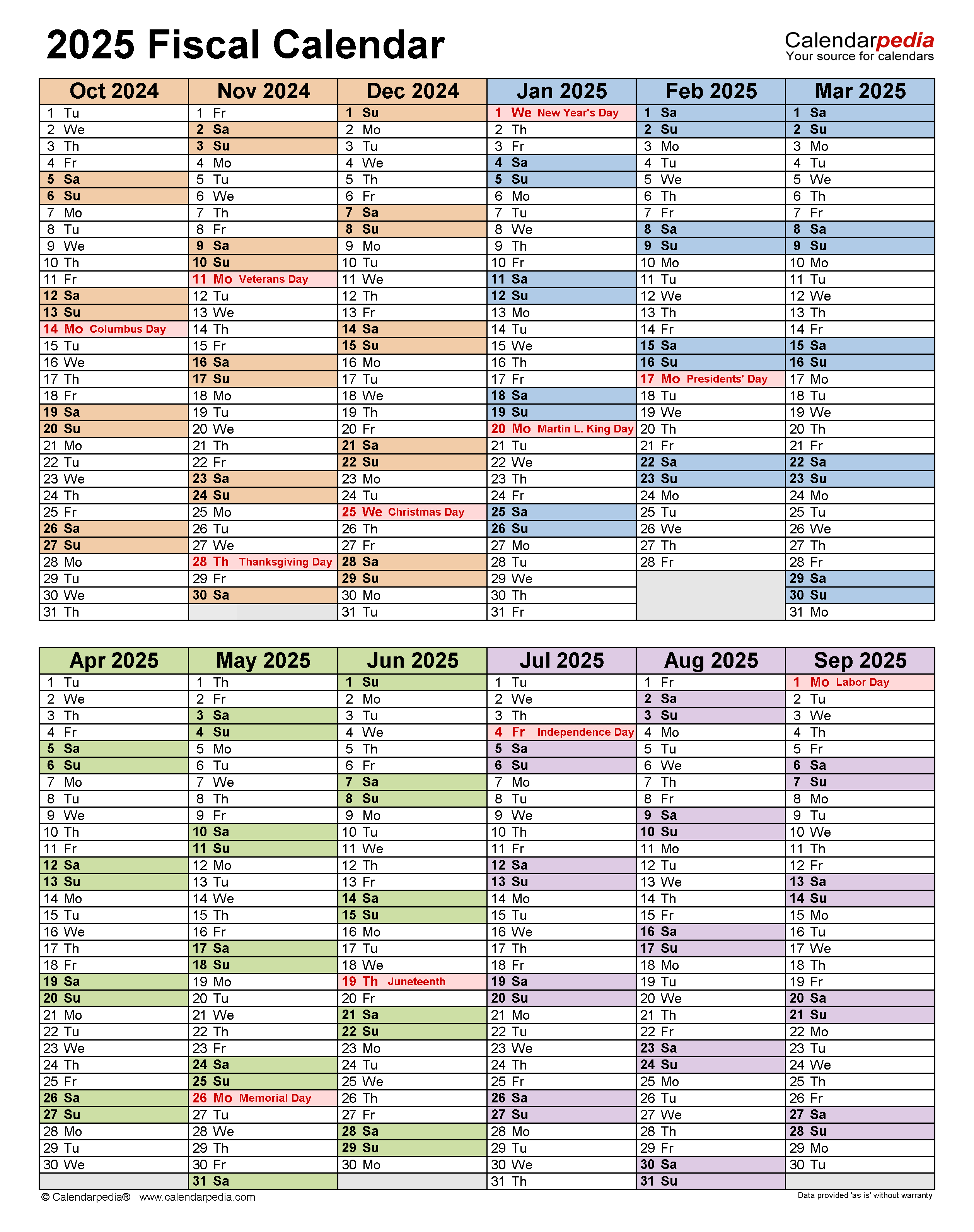

4-4-5 Fiscal Calendar for 2025

The following table shows the 4-4-5 fiscal calendar for 2025:

| Quarter | Start Date | End Date |

|---|---|---|

| Q1 | January 1, 2025 | April 30, 2025 |

| Q2 | May 1, 2025 | August 31, 2025 |

| Q3 | September 1, 2025 | December 31, 2025 |

| Q4 | January 1, 2026 | May 31, 2026 |

Conclusion

The 4-4-5 fiscal calendar offers several potential benefits for businesses, governments, and individuals. However, it is important to carefully consider the advantages and disadvantages before implementing this calendar. Organizations should consult with experts, assess their specific needs, and develop a comprehensive implementation plan to ensure a successful transition to the 4-4-5 fiscal calendar.

Closure

Thus, we hope this article has provided valuable insights into 4-4-5 Fiscal Calendar: A Comprehensive Overview for 2025. We hope you find this article informative and beneficial. See you in our next article!